[thumbnail]

Summary

Retailers in all sectors are looking to scale up online deliveries as consumers continue to move from brick-and-mortar stores to online platforms, leading to the need for increased delivery capacity. This trend has been greatly accelerated by the Covid-19 pandemic resulting in some consumers’ first experience of home delivery. Many of these new online consumers are expected to continue with home delivery even after social distancing requirements are a thing of the past, so this is the new normal for our sector.

The transition to a low-carbon economy, for years on the horizon, is now impacting the commercial vehicle sector. Government regulations, consumer pressure and increasing ethical awareness of investors are all forcing action. At the same time, the economics of electric vehicles (EVs) which were once prohibitively expensive due to high asset cost and low ranges are now approaching those of diesel vehicles.

EV refuelling depends on accessing sufficient electricity network connection capacity at depots or charging hubs. EV power needs are significant and will compete with other site demands like heating, lighting and cooling alongside other fulfilment equipment.

Addressing these needs only by increasing site capacity could be expensive as capacity upgrades compete with other businesses and domestic users who may also be looking for connection upgrades to support their EV or heat pump ambitions. The recent targeted charging review makes the costs of connection capacity much harder to avoid than under the current Triad based charging system, resulting in significant recurring costs to add to major upfront investments.

FPS uses its proprietary EVNow software tools to deliver simulation and analysis for companies considering large-scale EV deployments. Our models assess connection implications and costs on a site by site basis as part of developing and testing cost mitigations that can save millions of pounds. In this article we look at some of the issues and solutions.

Changing Environments

The retail sector is experiencing a fundamental shift in the way consumers shop. A 2019 report predicted that internet shopping is likely to account for 53% of retail sales by 2028, up from a fifth in 2019[i]. This trend has only been exacerbated by the ongoing COVID crisis and lockdown. The shift represents both a challenge and opportunity for retailers, as they seek to retain existing customers and capture larger shares of the market. For retailers to survive and thrive in this new world, existing delivery capacity must be scaled up to meet potential demand.

This consumer transition also coincides with the energy transition. Government pressure long focused on the power grid is finally turning attention to the transport sector, with several key pieces of legislation being passed at national and local level that will impact vehicles that can be purchased and used in cities around the country[ii], [iii].

To add to this, there is now an expectation from consumers for sellers to reduce their emissions. Sentiment among investors is also increasingly leaning towards green financing.[iv]

For retailers or third-party logistics providers operating their own fleet, transport is an obvious place to green their business. Transport related to last mile delivery is responsible for a large proportion of emissions from home delivery which increases dramatically when consumers require fast services.

The benefits EVs can bring to a business are not just limited to reducing greenhouse gas emissions and other harmful pollutants such as nitrogen oxides and particulate matter.

Over the past decade, battery cost has decreased greatly to compliment electricity costs that are much lower than diesel. In our last blog post “Cost-Effective Deployment of Electric Vehicles within Fleet Operations”[v], we shared FPS analysis showing how advances in EV technology allow EVs to achieve realistic break-even mileages with vehicle ranges which can satisfy business needs. However, before retailers and logistics players can make an effective transition, there is another challenge which needs addressing.

The Unseen Problem

While the transition to EVs is a necessary step that all fulfilment providers will have to make at some point, the new infrastructure required is often an overlooked cost. The vehicles are highly visible, but equally important is the grid supply infrastructure which refuels the vehicles. EV electrical loads can be substantial, especially when paired with the higher rated chargers required to turn vehicles around quickly for multiple shifts in a day (something which greatly increases vehicle utilisation and therefore asset paybacks).

As parcel, equipment and grocery delivery vehicles often operate the same shift patterns, the associated charging load is likely to have a low diversity factor resulting in high spikes at the end of each shift period. The shorter the time window to turn the vehicles around for the next shift, the higher the charger ratings are required which exacerbates the problem. Indeed, a site with just 5 vehicles may experience an associated charging load of 250kW when trying to turn the vehicles round in an hours’ time window. This is equivalent to doubling the peak electrical demand of some of the supermarkets and parcel depots we model.

EV charging loads will compete with static site electrical loads (such as cooling, heating and lighting) for a finite amount of power. Available Site Capacity (ASC) is the maximum allowed power drawn at a site which when exceeded frequently can incur significant penalties[vi] . These penalties are likely to increase in magnitude as overall grid capacity is further pressured in the future. If unaddressed these penalties will significantly affect the bottom line of vehicle operators, further increasing the challenge of generating profits from last mile delivery operations.

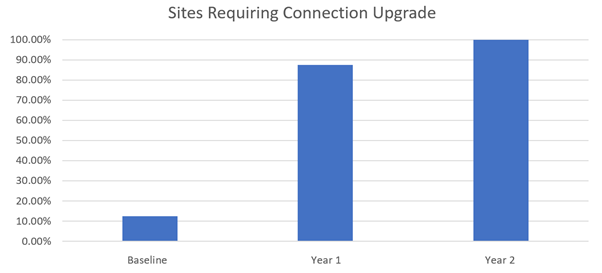

Recent FPS client studies have examined the ability of infrastructure to cope with current online demand and forecasts of future demand based on commercial targets.

In one study, at many depots assessed, rapid DC charging was required to double shift vehicles. When looking at current levels of demand, the existing ASC at each site was able to cope reasonably well with this new load. Breaches occurred at more than half of the sites but only at two were these frequent enough to warrant an upgrade to ASC.

The challenge comes from expansion in demand and heavier utilisation of vehicles. As demand grew in line with forecasts, nearly all sites modelled exceeded ASC capacity for more than 60 hours per year, increasing up to 80 hours per year in a subsequent year. At several sites ASC breaches were observed over 1000s of hours across the year. Once demand growth was considered, substantial ASC upgrades were required at almost all sites for profitable delivery operations. Costs of these capacity expansions ran to hundreds of thousands of pounds at some sites.

Not only is this problem complex but the window of time to plan for a most profitable transition is shortening as policy makers bring forward diesel vehicle phase out dates.

Managing the Risk

Simple analysis of infrastructure requirements using spreadsheets or global assumed values generates substantial risks of mispecifying infrastructure. Simple averages will tend to undersize assets whereas focusing only on the peaks can result in overcapacity.

Under-sized infrastructure could be costly, as installed grid and charging cabling may have to be ripped up and replaced with even more costly hardware. Meanwhile, the existing free capacity on the network may have already been bought up resulting in large upstream network upgrade requirements.

Over-sized capacity also represents an undesirable outcome due to the significant costs involved, representing wasted investment which could have been better allocated elsewhere. Recent changes to capacity charging arrangements mean this could be a significant ongoing cost as well as a one-off investment.

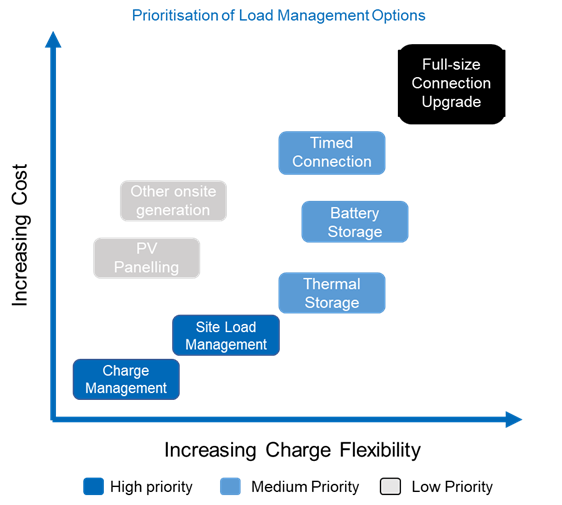

While the problem certainly poses challenges, with the correct analysis planning and a will to start, the risk to operators can be greatly reduced. FPS’ holistic models, considering detailed aspects of both site and vehicle operation such as smart charging and load management, can produce accurate load profiles for individual vehicle, painting a much clearer picture of the level of capacity required at each site and providing potential mitigations like those shown in the chart below.

By simulating the impact of these different measures on a site by site basis under a variety of scenarios across multiple years, we can arrive at cost effective solutions that are robust to the varying requirements of logistics operations.

If you would like to discuss how EV deployment may affect your grid connection requirements and ways to reduce these costs, please get in touch at info@flexpowerltd.com.

[i] https://www.theguardian.com/business/2019/jul/09/half-of-uk-retail-sales-will-be-online-within-10-years-report-predicts

[ii] https://www.bbc.co.uk/news/uk-england-35123873

[iii] [https://www.bbc.co.uk/news/science-environment-51366123]

[iv] https://eiuperspectives.economist.com/financial-services/sustainably-green-creating-sustainable-future-finance]

[v] https://www.flexpowersystems.com/cost-effective-deployment-of-electric-vehicles-within-fleet-operations

[vi] https://www.ofgem.gov.uk/publications-and-updates/distribution-connection-and-use-system-agreement-dcusa-dcp161-excess-capacity-charges]